Revolut‘s Playing the Tesla Game – But Can They Pull It Off?

Let’s Talk About Revolut’s Big Swing

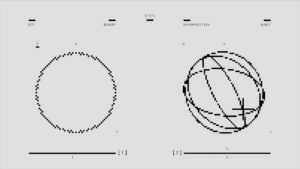

Okay, so Revolut isn’t exactly what your grandparents would call a “real bank.” And that’s the point. Over the past few years, they’ve been shaking up finance with their slick app, no-border-fee accounts, and letting people dabble in crypto like it’s no big deal. But now? They’re going full Elon Musk mode. The goal? To turn banking into something your grandkids will laugh about—like landline phones or fax machines. Question is, can a digital bank really pull a Tesla and rewrite the rules?

How Revolut’s Copying Tesla’s Homework

It’s All About the Vision, Not Just the Product

Here’s the thing about Tesla—they didn’t just sell cars. They sold this idea that the future was electric, whether Detroit liked it or not. Revolut’s CEO, Nik Storonsky, seems to be taking notes. He’s not just building a bank; he’s trying to build a financial Swiss Army knife that makes traditional banks look like those clunky Nokia phones from 2005.

So What’s Actually in Revolut’s Playbook?

- World Domination, Basically: They’re pushing hard into the US and Asia, even though regulators keep throwing curveballs. Classic “ask for forgiveness later” move.

- Throw Everything at the Wall: Crypto, stocks, insurance—why not? It’s like when your favorite app suddenly lets you order food. Convenient? Sure. Overkill? Maybe.

- The Fancy Stuff: Their Metal and Premium plans are basically the Model S of banking. Because nothing says “I’m serious about money” like a heavy metal card, right?

Breaking Down Revolut’s “Luxury” Tier

What You Actually Get

Imagine if Amex Platinum and a crypto exchange had a baby:

- 🏢 Airport lounge access (because fintech disruptors need free coffee too).

- 💳 1% cashback and travel insurance (handy, unless Revolut locks your account right before your flight—yeah, that happens).

- 🔶 That metal card? Mostly for flexing on social media. Let’s be real.

What People Are Saying (aka Reddit Drama)

Scroll through r/Revolut, and it’s a mixed bag:

- Love It: “Saved a ton on foreign transactions last vacation!”

- Hate It: “Their customer service is like yelling into a void.”

Why CNBC Might Put Them on Their “Disruptor” List

What That Even Means

CNBC’s Disruptor 50 is basically a hall of fame for companies that give old-school CEOs nightmares. Revolut’s got a shot because:

- 📈 They’re adding users like crazy—over 15 million and counting.

- 🔄 Profitability? Well… let’s just say they’re working on it. Rome wasn’t built in a day.

Who’s Trying to Steal Their Lunch?

Traditional banks are still stuck in paperwork hell. But competitors like Monzo and N26? They’re hungry. And as anyone on r/PersonalFinanceCanada will tell you, screw up customer service, and people will riot. Just ask Simplii.

The Big Hurdles: Regulation and Trust

Banking Licenses Are a Pain

Getting approved is harder than scoring a Cybertruck reservation. Revolut’s had delays in the UK and headaches in the US—kinda like Tesla’s factory permit battles.

The Customer Service Problem

For every loyal user, there’s someone tweeting about their account getting frozen for “suspicious activity” (aka buying coffee abroad). Revolut needs to fix this fast, or they’ll become another Silicon Valley “move fast and break things” cautionary tale.

Final Thoughts: Genius or Delusional?

Look, Revolut’s plan is either brilliant or borderline crazy—maybe a bit of both. They’re betting that banking in 10 years will look more like Tesla (tech-driven, bold) than Ford (slow, traditional). But hey, Tesla made it work. Can Revolut? Drop your thoughts below—I’m curious what you think.

Source: Financial Times – Companies